News

Allego is going public

28.07.2021

- Allego has entered into a definitive agreement with Spartan Acquisition Corp. III (NYSE: SPAQ); upon closing, the combined company will trade on the NYSE under the symbol “ALLG”.

- The transaction will raise a total of $702[1] million (assuming no redemptions), including $150 million from a fully committed PIPE, which will be used, among other things, to fund the combined company’s expansion plans.

- The PIPE is anchored by institutional investors, including Hedosophia and funds and accounts managed by ECP as well as strategic partners, including Fisker and Landis+Gyr. Funds managed by affiliates of Apollo Global Management, Inc., as sponsor behind Spartan Acquisition Corp. III, and Meridiam, as long-term owner of Allego, also participated in the PIPE.

- Allego has over 26,000 public EV charging ports across 12,000 public and private locations in 12 European countries, with leading utilization rates and a substantial recurring user base, as well as a secured backlog of 500 premium sites providing near-term visibility on network development.

- The pro forma implied equity value of the combined company is $3.14 billion. The transaction is expected to close in the fourth quarter of 2021, subject to customary closing conditions.

Paris, FR; Arnhem, NL; and New York, NY, July 28, 2021

Allego Holding B.V. (“Allego” or “the “Company”), a leading pan-European electric vehicle charging network, today announced a business combination with Spartan Acquisition Corp. III (“Spartan”) (NYSE: SPAQ), a publicly-listed special purpose acquisition company. The transaction will create a leading publicly traded pan-European electric vehicle (EV) charging company.

Upon completion of the proposed transaction, the combined company will operate under the Allego name, and will be listed on the New York Stock Exchange under the ticker symbol “ALLG”. The transaction values Allego at a pro forma equity value of approximately $3.14 billion. Expected total gross proceeds of $702 million will fund the Company’s future growth through the deployment of additional public EV charging sites, as it focuses on delivering fast and ultra-fast chargers and continues to build its technology moat.

Overview of Allego

Founded in 2013, Allego is a leading electric vehicle, or EV, charging company in Europe and has deployed over 26,000 charging ports across 12,000 public and private locations, spanning 12 European countries. In 2018, the Company was acquired by Meridiam, a global long-term sustainable infrastructure developer and investor, which provided necessary capital to enable the expansion of Allego’s existing global network, services and technologies. The Company’s charging network includes fast, ultra-fast, and AC charging equipment. The Company takes a two-pronged approach to delivering charging solutions, providing an owned and operated public charging network with 100% renewable energy in addition to charging solutions for business to business customers, including leading retail and auto brands. The Company’s charging solutions business provides design, installation, operations and maintenance of chargers owned by third parties. Allego’s chargers are open to all EV brands, with the ability to charge light vehicles, vans and e-trucks, which promotes increasing utilization rates across its locations. Allego has developed a rich portfolio of partnerships with strategic partners, including municipalities, more than 50 real estate owners and 15 OEMs. As additional fleets shift to EVs, Allego expects to leverage its expansive network of fast and ultra-fast chargers to service these customers, which see above average use-rates.

Allego’s proprietary suite of software, developed to help identify and assess locations and provide uptime optimization with payment solutions, underpins the Company’s competitive advantage. Allamo™ allows the Company to select premium charging sites to add to its network by analyzing traffic statistics and proprietary databases to forecast EV charging demand using over 100 factors, including local EV density, driving behavior and EV technology development. This allows a predictable, cutting-edge tool to optimize those locations that are best positioned for higher utilization rates.

Allego EV Cloud™ is a sophisticated customer payment tool that provides essential services to owned and third-party customers, including authorization and billing, smart charging and load balancing, analysis and customer support. This service offering is integral to fleet operators’ operations and enables the Company to provide insight and value to the customer, in addition to driving increased margins through third-party service contracts and operational and maintenance margins.

Allego continues to benefit from a European EV market that is nearly twice the size of the United States’ EV market, with an expected 46% CAGR from 2020 to 2025. Based on this projection, the number of EVs in Europe is expected to grow to nearly 20 million by 2025, as compared to 3 million today. The combination of a high urbanization rate and a scarcity of in-home parking means European EV drivers require fast, public EV charging locations that provide reliable and convenient charging. As part of the Company’s expansion plans, Allego will focus on fast and ultra-fast charging locations, which maximize utilization rates, carry higher gross margins and are required for fleet operators and EV drivers.

Additionally, stringent European CO2 regulations for internal combustion engines (ICE) and highly favorable incentives for electric vehicle purchases are expected to continue to drive adoption rates of EV over ICE vehicles. With a first mover advantage, a robust pipeline of over 500 committed premium sites to be equipped with fast and ultra-fast chargers, and an additional pipeline of another 500 sites, the Company is well positioned to execute its growth objectives and drive value creation for shareholders.

Through a diverse set of partnerships with leading OEMs, fleets, corporations, municipalities, and hosts, the Company has delivered significant revenue growth in recent years, including a 100% revenue CAGR from 2017-2020, and achieved positive operational EBITDA at the end of 2020.

Management Commentary

Mathieu Bonnet, Chief Executive Officer of Allego, commented,

“We are excited to announce our strategic partnership with Spartan, which will provide capital to accelerate our leadership position within the European charging market, all while maintaining a strong financial position throughout the growth phase. Europe has one of the largest populations of EVs in the world, which is continuing to grow at a greater pace than many other major growth markets, including the United States. Supported by these tailwinds and bolstered by the capital we are raising, we are well positioned to expand our footprint as EVs increasingly replace traditional internal combustion engines.”

Geoffrey Strong, Chairman and Chief Executive Officer of Spartan and Senior Partner and Co-Lead of Infrastructure and Natural Resources at Apollo added,

“We are excited to work together with Mathieu, Meridiam and the entire Allego team. We believe Europe is an extremely attractive market for EV charging and Allego is well-positioned to capitalize on its innovative technology, a strong leadership position in Europe, and supportive macro trends buoying the EV charging market.”

“At Spartan and Apollo, we are committed to advancing ESG-focused business models. We are excited to work with Allego as they execute against their compelling pipeline of growth opportunities and help eliminate emissions from the environment.”

Olivia Wassenaar

Director of Spartan and Senior Partner and Co-Lead of Natural Resources at Apollo Global Management, Inc. (“Apollo”)

Transaction Summary

The business combination values Allego at an implied $3.14 billion pro forma equity value. The combined company is expected to receive approximately $702 million of gross proceeds from a combination of a fully committed common stock PIPE offering of $150 million at $10.00 per share, along with approximately $552 million of cash held in trust, assuming no redemptions. The proceeds from the business combination will be used to fund EV station capex and for general corporate purposes.

Fisker, designer of advanced sustainable electric vehicles and mobility solutions, will make a $10 million private investment in the PIPE. Fisker is the exclusive electric vehicle automaker in the PIPE and, in parallel, has agreed to terms on a strategic partnership to deliver a range of charging options for its customers in Europe.

The PIPE is anchored by additional strategic partners, including Landis+Gyr, as well as institutional investors, including funds and accounts managed by Hedosophia and ECP. Investment funds managed by affiliates of Apollo Global Management, Inc., which own the sponsor behind Spartan, and by Meridiam, as long-term owner of Allego, also participated in the PIPE.

The boards of directors of both Allego and Spartan have unanimously approved the proposed business combination, which is expected to be completed in the fourth quarter of 2021 subject to, among other things, the approval by Spartan stockholders and the satisfaction or waiver of other customary closing conditions.

Meridiam, the existing shareholder of Allego, will roll 100% of its equity and, together with management and former advisors, will retain 75% of the combined entity. Meridiam will continue to be a long-term strategic partner to the combined company. Additionally, the European Investment Bank will maintain its role as capital provider to Allego.

Additional information about the proposed transaction, including a copy of the business combination agreement and investor presentation, will be provided in a Current Report on Form 8-K to be filed by Spartan today with the Securities and Exchange Commission and will be available at www.sec.gov.

Gross proceeds; not inclusive of estimated transaction expenses

Operational EBITDA means EBITDA further adjusted for reorganization costs, certain business optimization costs, lease buyouts, anticipated board compensation costs and director and officer insurance costs and anticipated transaction costs.

Related News

16.10.2024

Green Climate Fund and Meridiam unveil ambition and opportunities for impactful climate investments

03.10.2024

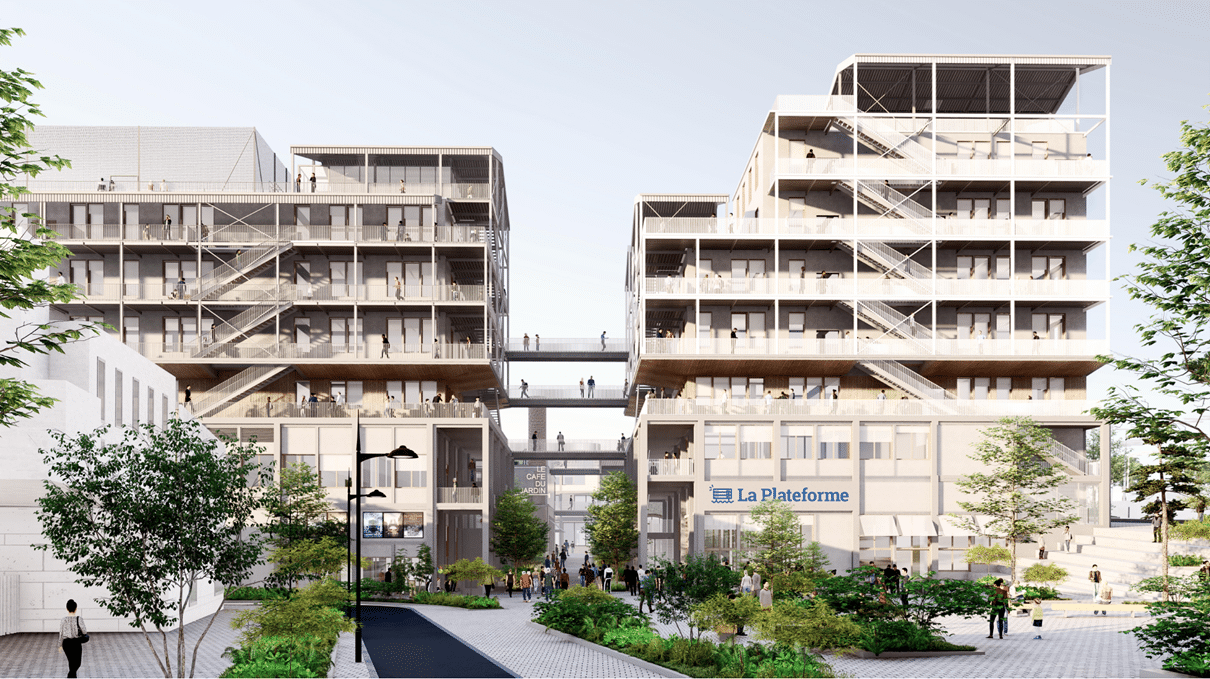

Construction begins on the second phase of La Plateforme A conversion/construction project to create a 25,000-sq.m digital campus designed as a ‘learning village’ in Marseille