News

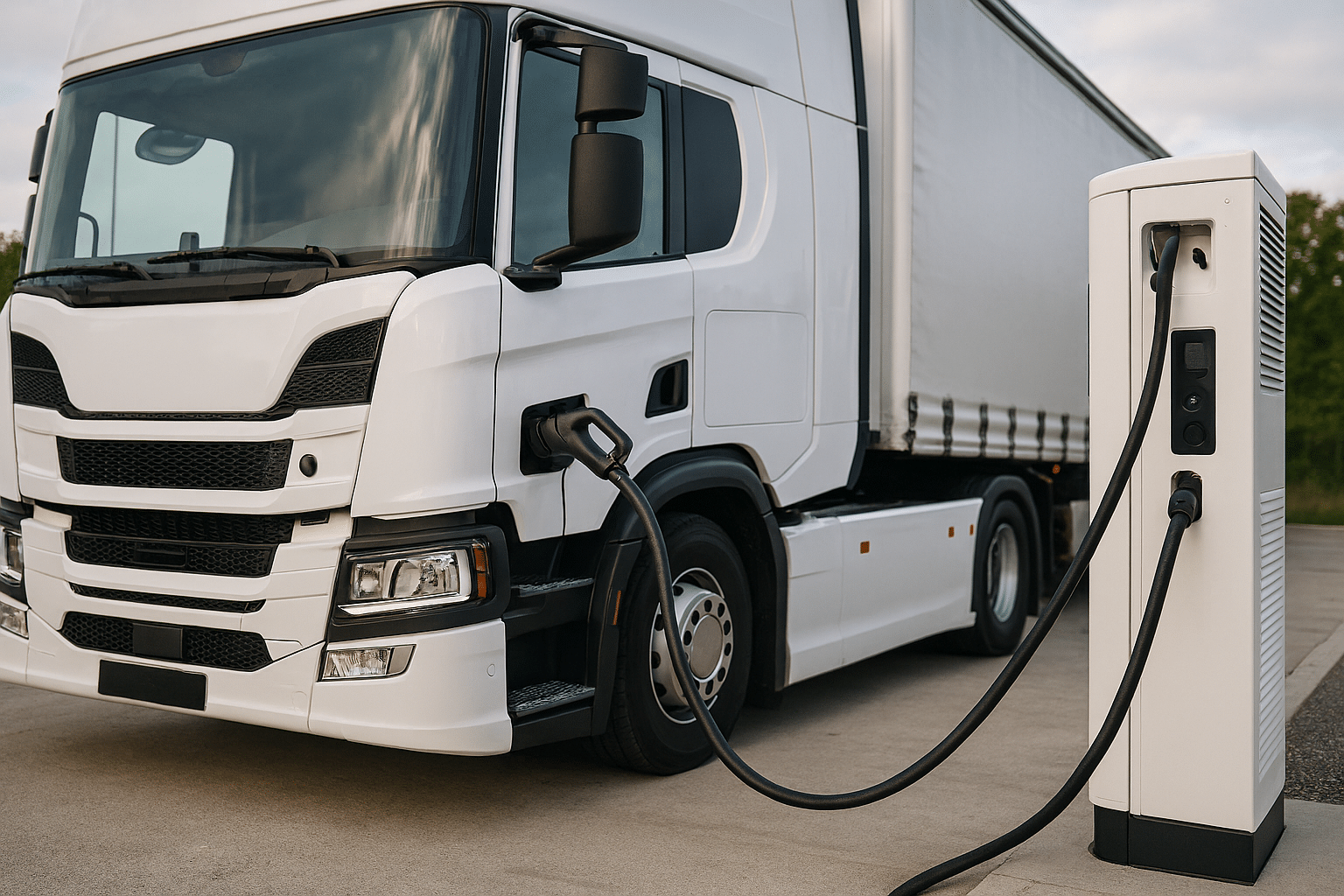

Sector focus: heavy vehicle electrification

29.10.2025

The Heavy-Duty Vehicle (HDV) sector is responsible for over 25% of greenhouse gas emissions from road transport.

The underlying market for heavy vehicles is substantial, with over 347k heavy trucks registered across all categories in 2023 in Europe[1]. The electric segment is still narrow but growing, with 10.8k registrations in 2023 compared to 1.7k units in 2021[2]. Germany, the Netherlands, and France lead in electric truck registrations, accounting for 41%, 17%, and 13% respectively.

The market is driven by the need for sustainable transportation solutions and stringent emissions regulations.

The EU aims to reduce the CO2 emissions of heavy trucks and coaches by 45% by 2030, 65% by 2035, and 90% by 2040[3]. Electrifying heavy vehicles can significantly reduce these emissions, contributing to cleaner air and improved public health. Thus, regulatory measures such as the Alternative Fuels Infrastructure Regulation (AFIR) mandate the installation of truck charging infrastructure every 60-10km by 2030, depending on the intensity of the zone logistical flows in the area[4].

The high cost of batteries, which can account for up to 50% of the vehicle price, poses a significant impediment to the development of this market. For a long-haul truck with a 700 kWh battery, the typical vehicle price is c.€215k of which c.€80k dedicated to the battery, compared to c.€110k for a combustion model[5]. However, investments by vehicle OEMs like Volvo Trucks as well as battery manufacturers are expected to drive down costs and improve the TCO. Battery prices are projected to decrease from $149/kWh in 2023 to $80/kWh by 2026[6]. As an illustration, the Volvo Group acquired a battery factory from Proterra in the US for c.€200m in 2024[7]. Electrified short-haul trucks that can charge everyday (typically overnight) at depot already have a better TCO than diesel-powered vehicles in Germany, thanks to lower energy costs. For long-haul, electric-powered vehicles are expected to outperform the diesel-powered ones in terms of TCO by 2030[8]. By 2030, battery electric trucks are expected to reach a [24-35]% market share among the new registrations in Europe, corresponding to at least c.120k vehicles per year[9].

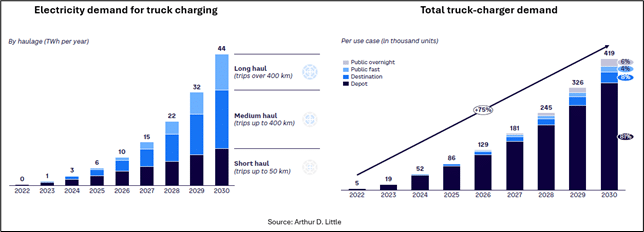

To enable the electrification of the fleet, a large roll-out of charging infrastructure is required. The total electricity demand for truck charging is expected to be multiplied by 10 from 2024 to 2030, driven by short and medium haul with depot charging[10]:

The charging station OEMs must work together with i) the tier-1 vehicle OEMs like Volvo Trucks (70% market share on electric trucks in Europe[11]) or Renault Trucks, which reference their preferred partners ii) large and local electricians, both for go-to market and installation matters[12]. The final customers, mostly logisticians, are looking for a turnkey solution including the charging stations installation, its operation and even sometime an integration with Transport Management System (TMS). Charging station suppliers like Tesla, ChargePoint, Chargepoly or Shell Recharge offer that kind of comprehensive value proposition. Traditional charging station OEMs like ABB, Alpitronics or Kempower primarily offer the hardware and often partner with Charging Point Operators like Mobilize or izivia.

In conclusion, this nascent market will present compelling investment opportunities in charging solutions for heavy vehicle electrification.

[1] Source: ACEA, 2024

[2] Source: IEA, Trends in heavy electric vehicles, 2024

[3] Source: European Council of the European Union

[4] Source: European Federation for Transport and Environment, HDV charging manual, May 2024

[5] Source: Strategy&, battery-electric truck on the rise, 2024

[6] Source: Goldman Sachs, 2024

[7] Source: Volvo Trucks 2024 annual results

[8] Source: Strategy&, battery-electric truck on the rise, 2024. Main assumptions: 300 km per day / 200 kW charging

[9] Sources: Strategy&, battery-electric truck on the rise, 2024; Market research by BDO Advisory and FFC (Fédération française de carrosserie), 2024

[10] Source: Arthur D. Little? Truck Electrification – Profit booster or white elephant?, 2023

[11] Sources: Transport & Environment, Ready or not: which manufacturers lead in the global race to clean up trucks?, 2023; Volvo Trucks 2024 annual results

[12] Source: Interviews conducted by Meridiam with two players in the EV charging industry and an electrician

Related News

17.02.2026

Meridiam announces the closing of its €2.2 billion Europe Core Fund and launches its first retail dedicated fund

29.01.2026

Meridiam, Partners Supporting Metro’s Sepulveda Transit Corridor Project’s Locally Preferred Alternative