News

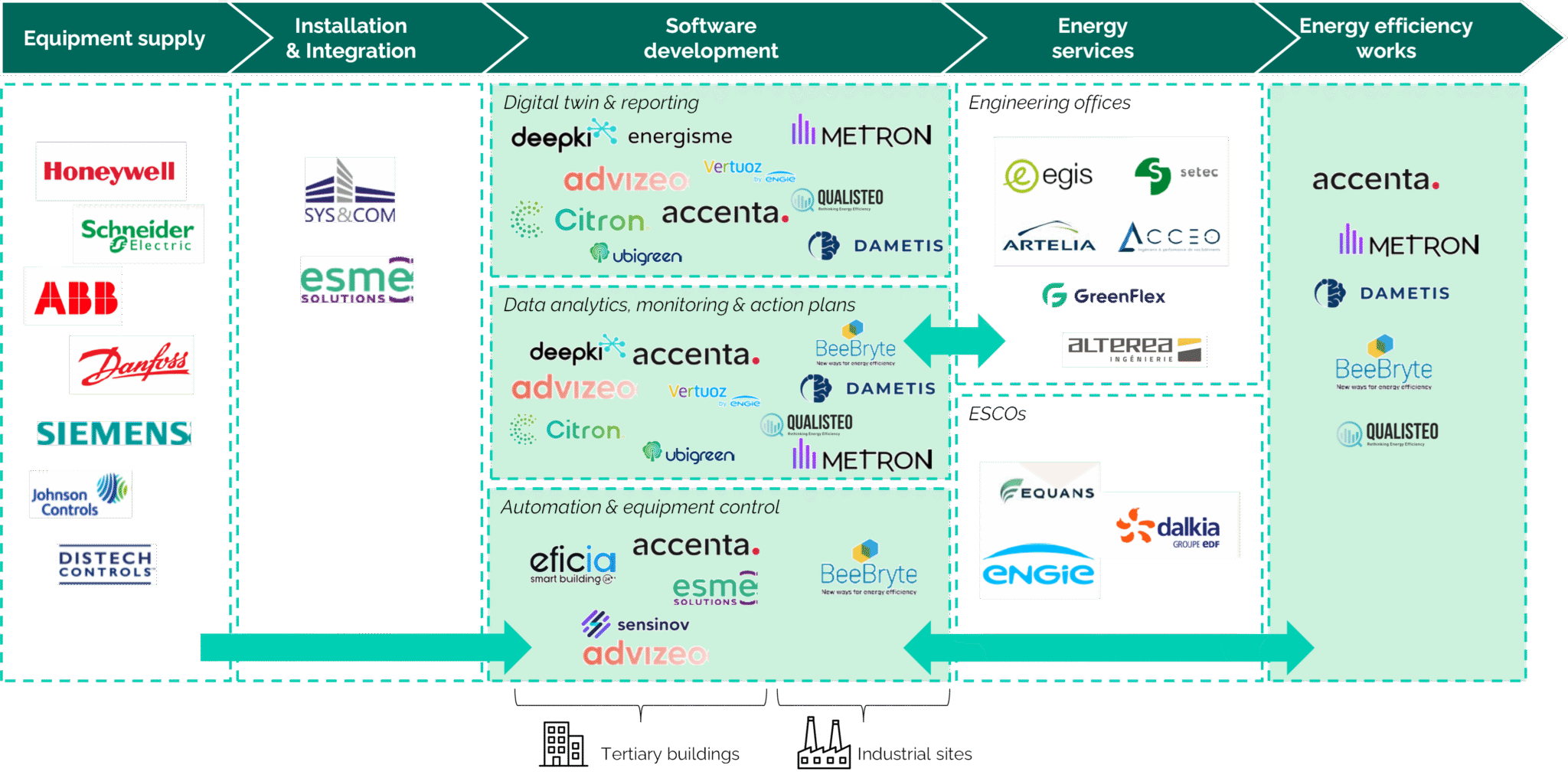

Sector focus: Energy Management Software (EMS)

29.10.2025

The built environment, which covers all the residential and commercial buildings, infrastructure, and public spaces that shape our daily lives, is responsible for 40% of energy consumption and 36% of greenhouse gases emissions in Europe[1]. Within that space, more than 50% of buildings’ CO2 emissions come from their energy consumption, the smaller half coming from buildings’ construction and maintenance. From a decarbonation point of view, addressing buildings’ energy efficiency is therefore critical.

The market for energy efficiency solutions has grown at a +9% CAGR over 2014-2023[2], with an annual recurring revenue potential estimated at close to €1bn in France alone. The adoption of technological tools aimed at monitoring, controlling and optimizing energy consumption in buildings or industrial sites is growing, at different rates depending on client profile: the private sector is relatively more mature and equipped (up to 70% for the largest corporates) than the public sector. Some large companies have been equipped with Building Management Systems (BMS) for over 10 years, but tools are often considered obsolete and will need to be replaced with next generation systems, allowing for a more precise monitoring of multi-fluid consumption data.

Regulation remains the strongest adoption driver. In France, two decrees shape the regulatory framework around building energy efficiency, pushing portfolio owners and asset managers to deploy energy management solutions:

- Décret Tertiaire: enforced since October 2019, the decree mandates a progressive reduction in energy consumption for tertiary-use buildings (offices, retail, education, etc.) of more than 1,000m². It sets binding targets of -40% by 2030, -50% by 2040, and -60% by 2050 compared to a reference year between 2010 and 2019. Building owners and tenants must notably report their annual energy consumption via the OPERAT platform managed by ADEME, making a reliable monitoring tool compulsory.

- Décret BACS (Building Automation and Control Systems): introduced in 2020 and updated in April 2023, the decree requires the installation of automation and control systems in non-residential buildings with HVAC (Heating, Ventilation and Air Conditioning) systems exceeding 290 kW (by January 1, 2025) or 70 kW (by January 1, 2027). It applies to both new and existing tertiary buildings and aims to optimize energy performance through real-time monitoring, regulation and automation.

In parallel, geopolitical crises since 2022 and budgetary constraints on both public and private sector asset owners motivate the adoption of solutions with a short ROI. Energy Management Software (EMS) typically allows to save on average 10-20% on energy bills.

Change management within technical teams remains a challenge, especially for solutions providing automated control over BMS or HVAC equipment, which may create conflicts of interest with facility management and maintenance operators. Software providers therefore need to ensure an easy solution set-up, frictionless integration in clients’ work environments, and good collaboration with third-party contractors.

Players active on the software development and distribution block of the EMS value chain seldom have a pure SaaS business model, but rather a mix of one-off and recurring revenues, including subscription, set-up services, support services (e.g. energy audits, action plans…) and sometimes complementary hardware sales (e.g. sensors, smart meters…) and energy efficiency works (e.g. installation of a new BMS).

Over recent years, the main market players have been following two different trajectories in terms of product strategy:

- Diversification toward ESG reporting and asset portfolio management (e.g. Deepki), targeting investors, CFOs, ESG teams, and asset managers. The value proposition relies on the increase in portfolio value implied by best-in-class ESG performance.

- Focus on automation and BMS/HVAC equipment control (e.g. Advizeo, Beebryte), targeting building managers and technical teams. The value proposition relies on the energy savings realized by automating the implementation of action plans aimed at optimizing energy consumption.

Overall, the market shows a clear trend toward vertical integration – either from hardware to data analysis and intelligent management, or from software to IoT and implementation of energy performance upgrades. The objective being to capture additional value through cross-selling and better amortize customer acquisition costs, in an environment where sales cycles are often long (>6-12 months).

The market has also already started to consolidate, with several acquisitions by industrial players over the past two years. As an example, the German specialist of electrical equipment Hager Group successively acquired Eficia in July 2023 and Advizeo in August 2024, two EMS pure players with a focus on IoT and automation. Hardware providers are thus progressively integrating smart energy management solutions in their offering.

In conclusion, the EMS market is an attractive field for growth investors, driven by regulation and cost pressure, with significant opportunities to scale within large portfolios of buildings. The winning players demonstrate short ROIs, controlled customer acquisition cost, user-friendly interfaces and a good level of technical customer support adapted to the least sophisticated users. Investors should however keep in mind that consulting services are often inherent to EMS business models, leading to different valuation levels compared to pure SaaS businesses.

[1] Source: European Commission, 17 February 2020

[2] Source: Xerfi

Related News

17.02.2026

Meridiam announces the closing of its €2.2 billion Europe Core Fund and launches its first retail dedicated fund

29.01.2026

Meridiam, Partners Supporting Metro’s Sepulveda Transit Corridor Project’s Locally Preferred Alternative