Sustainability strategy

Methodology

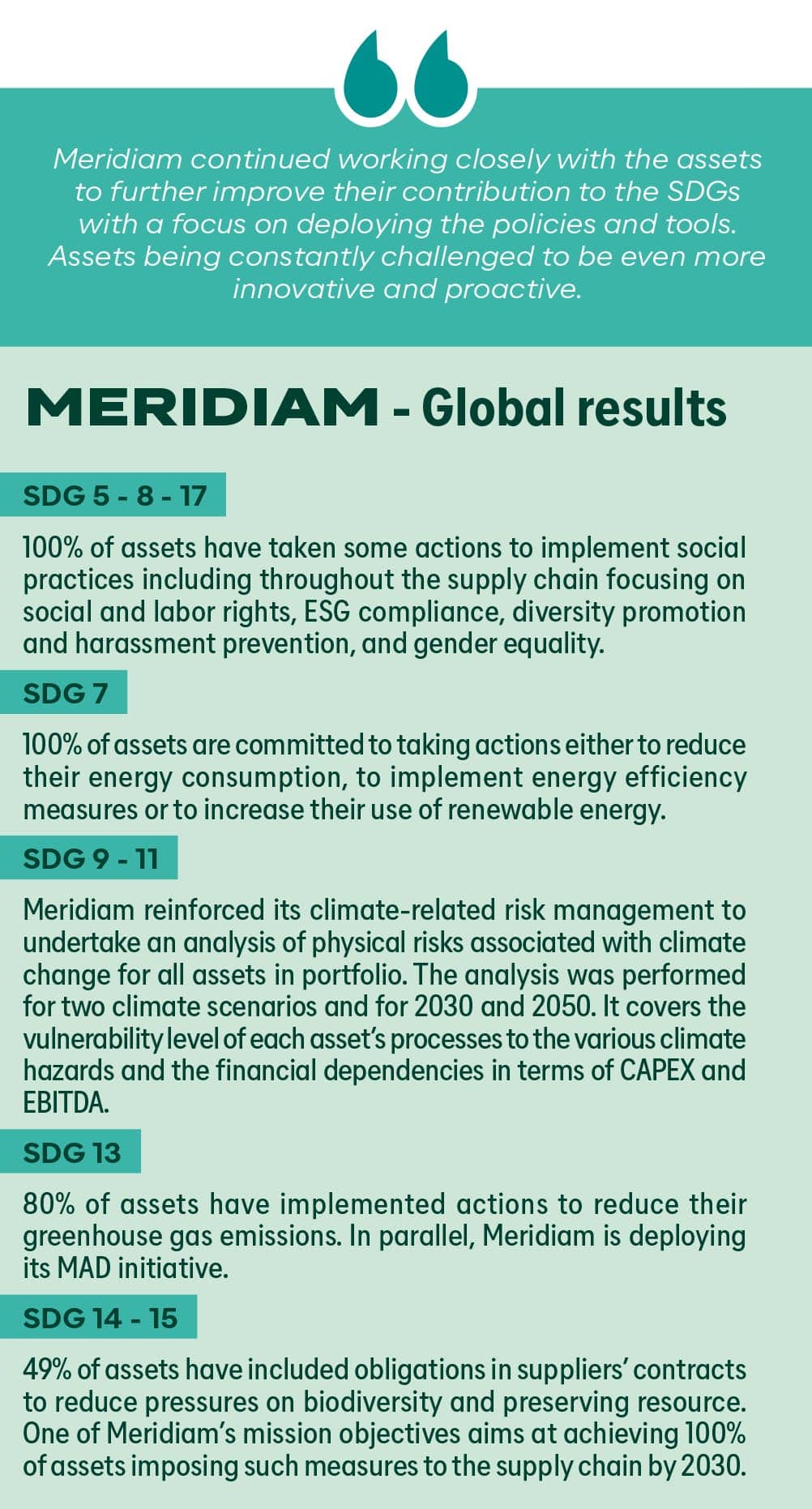

For impact to be effectively delivered, it must be measured. Following our adoption of the SDGs in our investment processes and targets, we created a unique methodology for measuring and reporting impact.

This adaptable and detailed framework enables Meridiam to monitor and transparently report our performance against the SDGs across individual investments, funds and our organisation as a whole.

For impact to be effectively delivered, it must be measured. Following our adoption of the SDGs in our investment processes and targets, we created a unique methodology for measuring and reporting impact. This adaptable and detailed framework enables Meridiam to monitor and transparently report our performance against the SDGs across individual investments, funds and our organisation as a whole.

We believe that it is not enough just to measure our impact. Our methodology helps us identify the main areas of potential improvement for each asset, allowing Meridiam to develop and implement roadmaps to deliver even greater benefits. We do not look at our assets in isolation but benchmark them against their peer group and specific economic and geographic context to better track their achievements regionally and internationally. We take measurements annually and present the results in our Impact Report.

Our Investor Hub provides an advanced online tool that allows investors to view our performance and understand how it helps meet their own objectives.

Our impact in numbers

The impact measurement & monitoring tool, SIMPL.

SIMPL. stands for ‘Sustainability Impact Measurement Platform’ (SIMPL.) and is an online platform that tracks and monitors the impact of assets against ESG targets and the United Nations Sustainable Development Goals (UN SDG).

The interface is intuitive, easy to use and shows in real time the concrete impact of assets.

The name SIMPL. comes from the purpose of the platform and illustrates how the platform works. It is simple by design, allowing its clients and investors to easily see progress and where performance can be improved – from the start of the project, right through to completion.

Created by Meridiam in 2018, this monitoring and management tool is now a Software as a Service (SaaS), commercialized for financial market clients and corporates through an independent company*. Meridiam is now a client of SIMPL., and not the only user of this pioneering impact evaluation solution.

The methodology and functionalities of SIMPL. evolved in 2023 to align with market needs and enable even more informed and strategic decision making for organizations. It monitors and reports concrete contributions of any assets/activities under the UN SDG framework. But now, following the addition of separate modules, it offers regulatory and compliant reporting regarding the EU Taxonomy and SFDR/PAI frameworks.

* joint venture between Meridiam and Blunomy (the specialized consultant with whom the tool has been historically developed)

Enhancing our evaluation

At Meridiam, we look at our investments from different angles to ensure that they deliver against our exacting impact targets, as well as international standards. In addition to our unique SDG-based impact methodology, we adopt measurements to assess our performance towards climate goals and carbon emissions.

Across our infrastructure assets and our organisation, we actively track our carbon footprint to determine the volume of emissions avoided by our actions. In addition, we have teamed up with fellow industry players to create the 2-infra challenge framework. This tool enables us to measure our portfolio’s alignment with the 2°C target adopted by 196 countries in the 2015 Paris Agreement.

Our wide-ranging and rigorous approach ensures we stick close to our development objectives and capture the positive contributions of our infrastructure assets in areas including education, energy, environment, health, social justice, urbanisation and water.

Ambitious targets

Meridiam places just as much weight on meeting ambitious social and environmental goals as achieving financial returns. As an investment manager committing capital to infrastructure investments for 25 years and longer, our alignment of interest ensures consistent quality of service for public bodies, and attractive returns for our investors over the long term.

Our team is organised and incentivised to deliver both. Individuals’ carried interest is linked equally to financial and impact-centred KPIs. And should our funds fail to meet our impact goals, then we sacrifice a portion of our overall carried interest entitlement, regardless of their financial performance. We believe that impact must be embedded in our remuneration as well as our actions.

Meridiam’s governance has evolved to be consistent with our mission. We established a Mission Committee to monitor the impact of our investments against our Five Pillars and set new targets for improvement. This Mission Committee includes Thierry Dallard – Mission Committee Chair, Joe Clark of the Supervisory Board, Thierry Déau, Ginette Borduas from our staff, Françoise Tauzinat and Patrice Garnier, who are independent members from the industry. We conduct regular audits of our operations and investments using external specialists, and report regularly on our performance towards our Sustainability Charter.