Our Impact

Democratizing access to ESG data with ESG Book

Sector: Low carbon economy

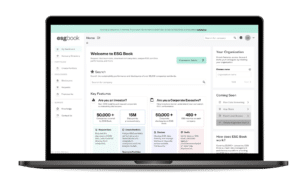

ESG Book is a global leader in sustainability data and technology. The company’s cloud-based platform makes ESG data accessible, consistent, and transparent, enabling financial markets to allocate capital towards more sustainable and higher impact assets. ESG Book enables companies to be custodians of their own data, provides framework-neutral sustainability information in real-time, and promotes transparency.

ESG Book has a license-based model to provide ESG data that they own with a layer of proprietary analytics (scoring, regulatory screening, etc), mostly to financial actors as well as corporates. They have more than 100 clients across the world including Bloomberg, Nasdaq, Citi, Accenture, JP Morgan and many others convinced by the quality of the data gathered in formal reports and on a daily basis over the web

One of the main value points unlocked by the company by the fact that it owns the data is full transparency: anyone can audit every single data point. In addition, they are the only data-owning platform not linked to a major index / rating agency.

> 25k

listed companies through 450 ESG data points

> 100

leading clients

90+

transparent frameworks

Through its Green Impact Growth Fund (GIGF), Meridiam invested in the €25m Series B round with Energy Impact Partners (EIP), a leading US-based climate impact fund, and former investor Allianz X.

Why We Invested in ESG Book

To build one of the world’s leading ESG data platform:

- Become the reference for ESG data for all asset classes, including private companies and real assets

- Build a referential-agnostic environment that complies with all regulatory frameworks

- Develop market leading measurement tools and frameworks, and host all major tools on the platform

ESG Book’s impact

ESG Book is clearly contributing to the positive transformation of the economy, providing financial actors with the capacity to better invest towards ESG performing actors and have an actual impact on reaching global targets. It also provides means to comply with the regulation, starting with SFDR in Europe for instance.

ESG Book is focused on providing enabling impact, not being directly involved in the “physical economy”. In this context, it is aligned with one of the three major goals that were settled by the United Nations in the Paris Agreement. It also contributes to many United Nations Sustainable Development Goals, having a transversal impact on them, but with focus on the coordination ones, being SDGs 16, 15, 13 and 8.

> Learn more from the press release

Source:

1). UBS –Future Reimagined: Will ESG Data and Services Demand Accelerate Post-COVID & Who Will Win? 2020